Now that community banks are emerging from the shadows of the Paycheck Protection Program and COVID-19 lockdowns, it might be a good time to dust off some of the projects that were on our radar before the pandemic. One of our clients might have said it best when he said, “I can once again hear the CECL drums beating off in the distance.” The Current Expected Credit Loss (CECL) standard is getting closer and closer, and this summer is a good time to revisit the upcoming change.

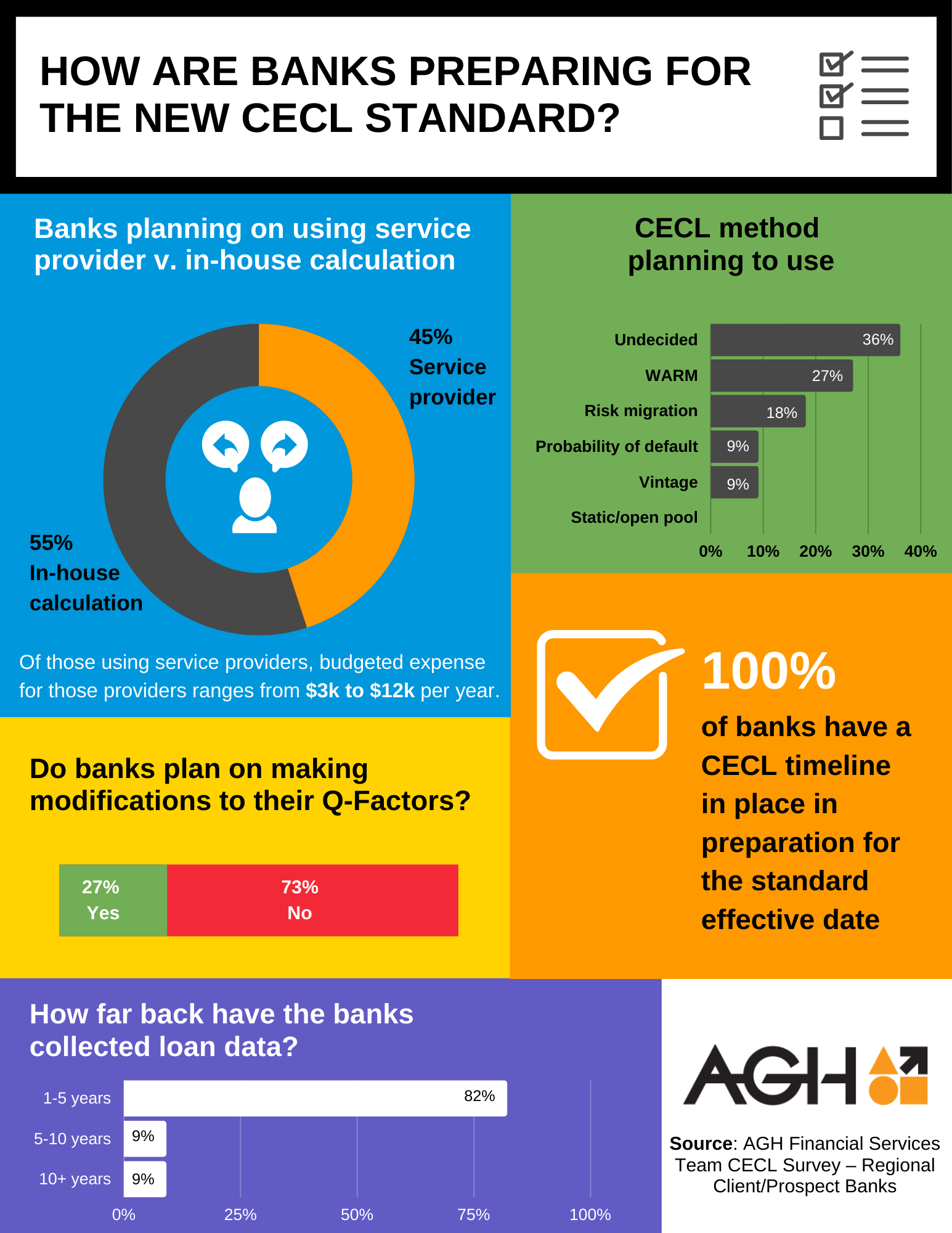

We surveyed regional banks to measure where community banks are in their CECL process and to also identify trends or concerns that need addressed before the standard becomes effective in 2023 (for non-public banks).

Click image to expand

Click image to expand

As our infographic outlines, 36% of banks in the survey still have not decided on a specific CECL method to use. As a starting point, we summarized each method so you can further evaluate which may be the best fit for your bank.

Discounted Cash Flow (DCF)

This method is done at the account level and models the expected cash flow on a loan-level basis and aggregates results at the loan pool-level. This calculation can be rather complex when taking into consideration the timing of cash flows such as prepayments, projected charge-offs, and projected recoveries. If this method is chosen, a bank should have robust loan data and statistical data to show correlation of charge-off and recovery data used in the forward-looking payment stream.

Probability of default / loss given default

The probability of default is the average percentage of borrowers who default over a certain period. The challenge in this method does not lie in the formula or computation, but the underlying data that needs to be extracted to be put into the formula. First, any bank must estimate over what period a “default” should be measured (for example, 90 days). Then, at the loan level, the bank must collect data that shows loan type, current balance, credit quality, loan rating, charge-offs, recoveries, and payment data. This data will be used to determine a default rate and loss rate per loan pool. While the data for this method is complex, we have seen growing popularity in this method from FASB and publicly traded institutions. This can be attributable to the reliability of this method from the high correlation of past due loan information to credit losses.

Regression analysis

This method uses correlations in economic data to estimate future losses in particular loan pools. For this method to be reliable, the bank needs to have historical economic datasets and bank specific datasets that would be large enough to find a supportable statistical correlation between the data and projected losses. Some examples of this economic data would be unemployment rate correlation to bank charge-offs or changes in the Consumer Price Index (CPI) to bank charge-offs.

Risk migration (migration analysis) by loan rating

This method tracks the changes in the credit quality of a loan portfolio over a period and compares to the timing of credit losses within those loan pools. This method would be viable for those banks that have a strong loan rating system that is consistently applied and updated. This method will correlate losses to specific loan pools that might have higher risk ratings or adverse rating changes within a loan pool.

Vintage methodology

This method measures the expected loss based on historical performance of loans with similar life cycles and risk characteristics. This could be best applied to loan pools that have similar loans that closely follow the same loss curves, meaning that these loss curves would be predictive for future periods. We have seen this method mostly applied to auto loans and other consumer loan pools.

Open / static pool method

This method tracks the losses in a closed pool of loans for a period and calculates a loss ratio for that pool. These loss ratios are calculated for multiple periods to estimate an average loss rate over a set number of years. This method would be best to apply to loan pools without a large amount of loans, or loans that do not have risk data available such as an individual loan rating, charge-off/recovery information, etc. or a specific loan pool that does not have a reliable correlation to available economic data.

Weighted Average Remaining Maturity (WARM)

This method simply takes a periodic loss rate and extrapolates that loss over the remaining life of a specified loan pool. Data that would need to be compiled needs to include loan level information that would allow a bank to accurately measure the duration of a specified loan pool. There is also a prepayment assumption that would need to be made, which might not be available from your data providers. This method has been widely shown as a popular example from bank regulators and FASB for community banks. While this calculation is straightforward and information is readily available to calculate it, this might not be the best calculation for every loan pool on estimating a future loan loss.

Additional considerations

The method that may be best for your bank might not be comparable to other institutions, even within your peer group or of similar asset size. Take time now to look at your loan portfolio, how your loan portfolio is disaggregated into loan pools and determine which method would be best for each pool.

There are several ways that a bank can implement a CECL model. According to our survey, 55% of the banks plan on doing a calculation in-house. If your bank chooses this method, consider reaching out to your advisors to ensure your calculation aligns with your bank’s risk profile and US GAAP. Several service providers will also either provide a CECL model or CECL calculator for the bank to use in calculating their CECL reserves. Recently, the Federal Reserve has also announced they will provide a CECL tool for community banks to use if their asset size is less than $1 billion. We think all options can be viable with the proper planning and consideration.