At first glance, IC-DISC may seem intimidating, but it’s actually a relatively simple process that can result in substantial tax savings for U.S. exporters.

IC-DISC was first enacted by U.S. Congress in 1971 as an attempt to level the playing field for U.S. exporters. Although changes have been made over the years, it still remains a great option today, with the ability to increase a company’s after-tax cash flow by up to 16 percent.

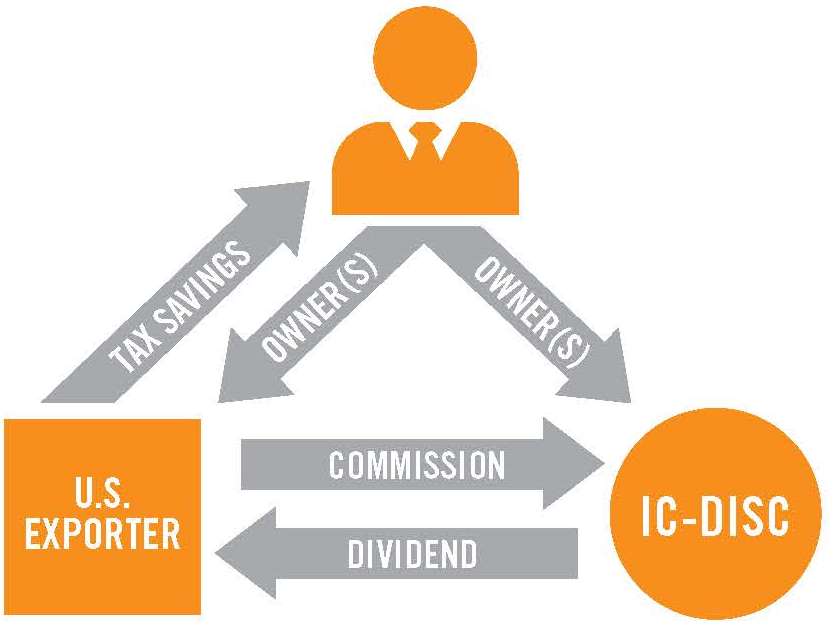

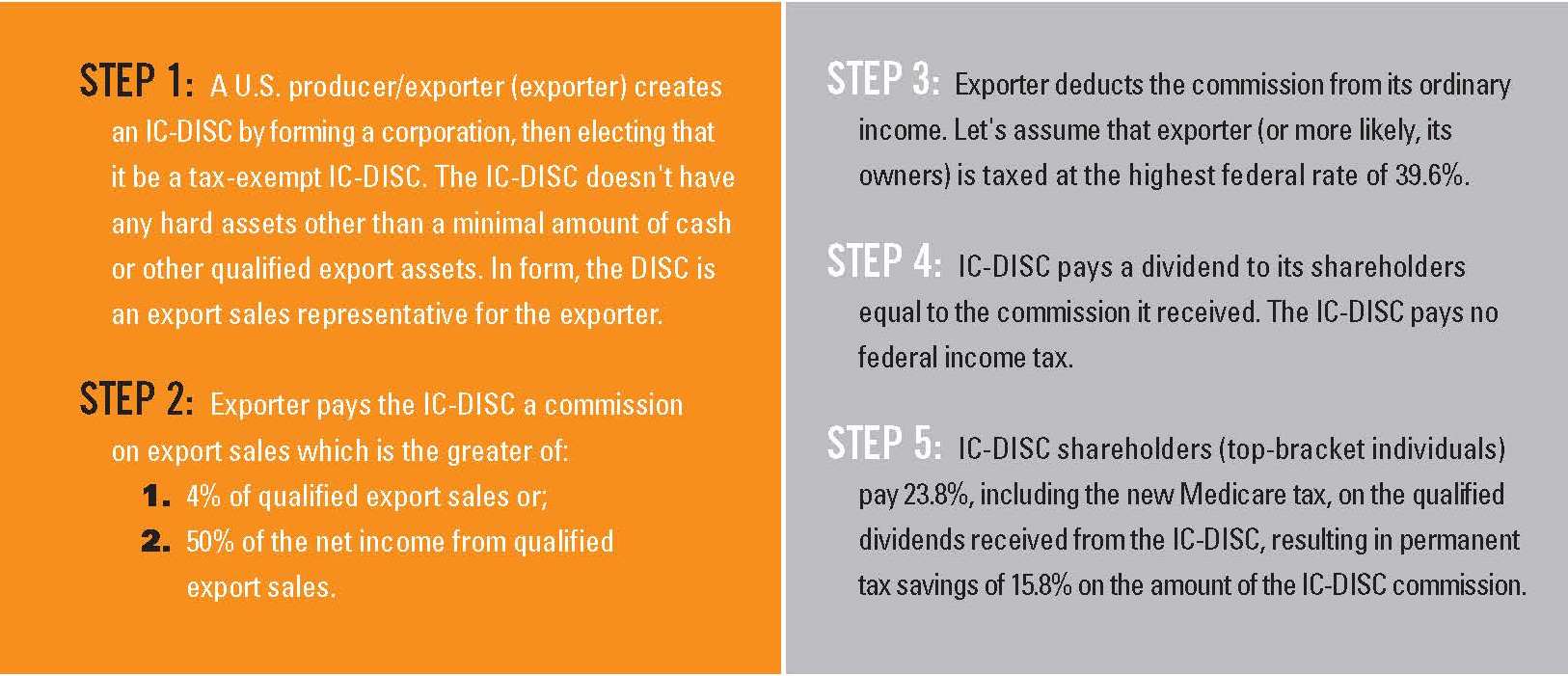

In the process, the exporter’s operating entity creates a new “paper” corporation which, upon IRS approval, becomes an IC-DISC. The operating entity then pays a commission from its export sales to the DISC, which is either paid directly to the DISC owners as a dividend (for permanent tax savings) or loaned back to the operating entity (for tax deferral).

What is an IC-DISC?

The IC-DISC, or Interest-Charge Domestic International Sales Corporation, is the only Congressionally endorsed export tax benefit remaining in the Internal Revenue Code. For nearly all companies with export sales, setting up an IC-DISC can deliver significant tax savings.

Assuming maximum tax rates apply, an IC-DISC can help an exporter realize a permanent tax savings for the difference between the ordinary tax rate and the capital gains rate – usually at least 15%. This is accomplished by creating a separate “paper” entity typically owned by the export company or the same individuals as the export company.

Unfortunately, only export sales made after formation of the IC-DISC will qualify, so time is critical.

How does it work? What are the benefits?

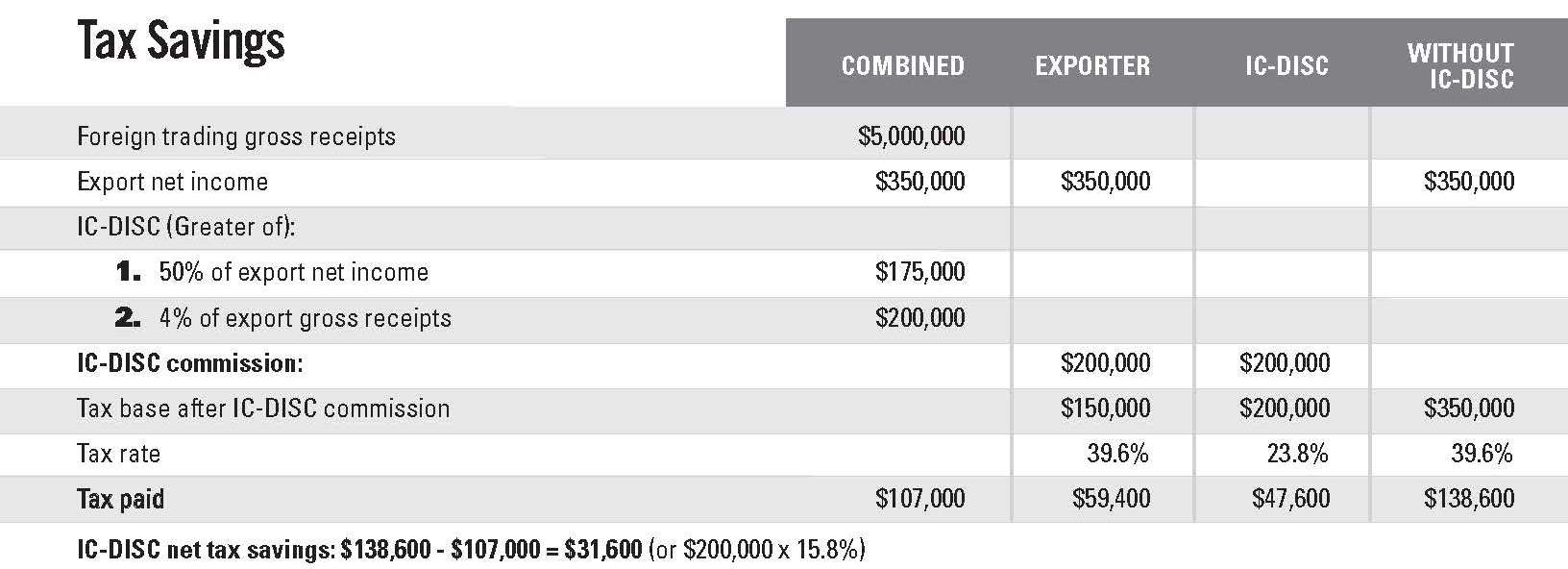

The best way to illustrate this main benefit of an IC-DISC is through an example:

Learn more

There are a number of considerations and benefits that should be explored before implementation of this tax strategy. If you have further questions regarding IC-DISC, you can reach Shawn Sullivan using the information below.

Executive Vice President

Tax Services

Shawn leads the firm’s tax group and serves on AGH’s board of directors. In addition to enhancing business performance to minimize tax consequences, he has extensive experience in mergers and acquisitions, international tax and business structuring. Shawn has public and private experience in the fields of tax and accounting and works frequently with clients in the manufacturing, automotive, wholesale distribution, real estate development and construction industries.

A certified public accountant, Shawn is a member of the American Institute of Certified Public Accountants, the Kansas Society of Certified Public Accountants (KSCPA), and the KSCPA Committee on Taxation.