The do-it-yourself (DIY) trend can be a good thing when you’re changing your oil or painting your living room a new color – but even then, you’re accepting some risk, ranging from living with an ugly color to blowing your car’s engine. Where your physical or fiscal health is concerned, however, a DIY approach must be more carefully understood and analyzed. Just as you might not want to take your own appendix out, you’ll likely benefit from understanding the risks and benefits of DIY business valuation compared to business valuation from a highly trained and accredited professional – especially if your money’s at stake.

A number of websites have popped up which advertise low-cost, quick, and DIY business valuations. AGH’s business valuation team offers this comprehensive review of how the two compare. While this article focuses on the differences between DIY and AGH valuations; it is not a complete description of the AGH valuation process.

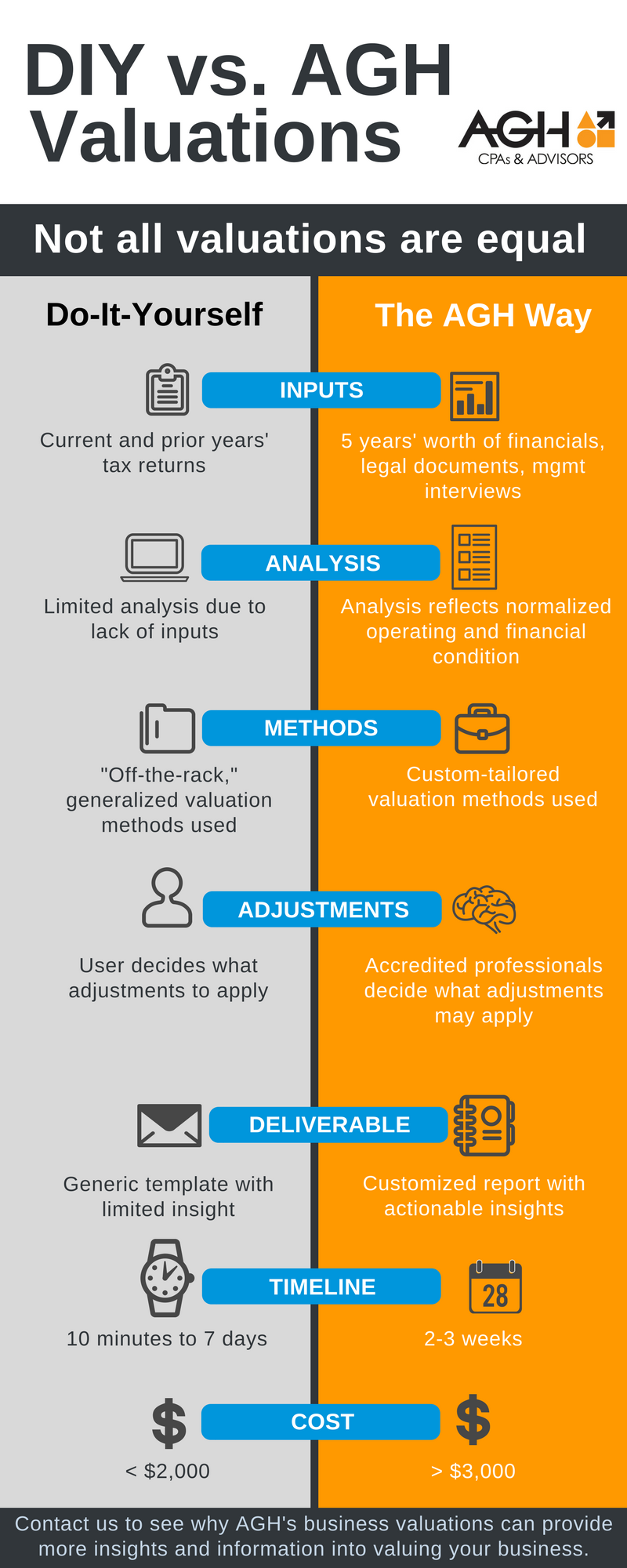

Inputs: What information is used to generate the valuation?

Value is forward-looking – what will a business be worth at a future point in time? Many DIY valuations consider only a year or two of historical financial results, which may not be an adequate representation of a company’s future income-generating ability. Further, AGH’s interviews with management/ownership are critical in determining ongoing, sustainable cash flows with which to value a company.

Unlike DIY valuations, we request and read all of a company’s governing legal documents to understand (1) restrictions on sale of company ownership interests, (2) buy-sell agreements in place, (3) dissolution provisions, and (4) owner rights to distributions, if any. All of these provisions and more have an effect on a company’s value, but aren’t factored into a DIY valuation process.

These management interviews, comprehensive look at historical financials and projections, and review of legal documents give AGH accredited valuation professionals an understanding of the company and its underlying value drivers.

Analysis: Do the financials accurately demonstrate the company’s value?

Much of AGH’s analysis and interviews with management center around normalization adjustments which alter a company's historical financial statements so that they reflect its true operating performance and financial condition. This is a critical step in accurately determining an opinion of value and seems to be omitted from the DIY method – likely a function of the DIY process, which by its nature has limited input from a professional valuator.

Many privately held companies deviate from normal accounting practices or have financial statements that often include nonbusiness-related expenses. Normalizing adjustments to the income statement are made for numerous reasons, but typically involve discretionary expenses with related parties such as salaries, rent, or benefits that may not align with market rates; one-time gains or losses; other unusual, nonrecurring, or extraordinary items; discontinued business operations; and expenses or revenues related to non-operating assets. Keeping these items on an income statement distorts a company's true earnings capacity.

Methods: What valuation method is used – and why?

The valuation methods applied to a company are dependent on company-specific factors, including growth and risk, and are based on the experience and judgment of the AGH valuator. In other words, blanket application of valuation methods to a company regardless of industry, background, and other factors may yield nonsensical results under the DIY valuation.

Adjustments: What other factors may affect the valuation, and how are they reflected?

The DIY method appears to have no mechanism by which accredited valuators consider, determine, and apply appropriate adjustments related to the subject interest’s control, marketability, voting ability, etc. or the company’s structure, key-man presence, goodwill, etc. These adjustments are a critical step in an accurate valuation and may have a huge impact on transfer taxes and values.

Deliverable: What information does the valuation report contain?

Every page of an AGH report is company-specific; DIY reports typically appear more templated and “one size fits all.” AGH’s reports are written to be used as management tools with which to grow future value and improve company operations. Our professionals also discuss the results with management and revise as necessary. The final conclusion of value is supported by the valuation report. The significance of the company’s value warrants the judgment and experience of an accredited valuator from start to finish in the valuation process.

Timeline: What kind of quality control is conducted?

There are several steps unique to an AGH valuation as compared to DIY that require more time, but result in a more accurate valuation. These include ongoing dialogue between managers and AGH and incorporation of that information into the valuation, AGH internal collaboration between valuation professionals and quality control reviews, and submission of the draft report to the owners for feedback with any related changes.

Cost: What’s the cost of an incorrect business valuation?

According to an article from the Washington Post, a typical owner misjudges the value of his or her company by 59%. Important financial decisions, related to retirement, succession, or transaction planning, to name a few, rely on the concluded value. Peace of mind and security regarding the accuracy of the resulting value may be commensurate with a business owner’s investment of time and resources in the valuation process.