Is your organization eligible?

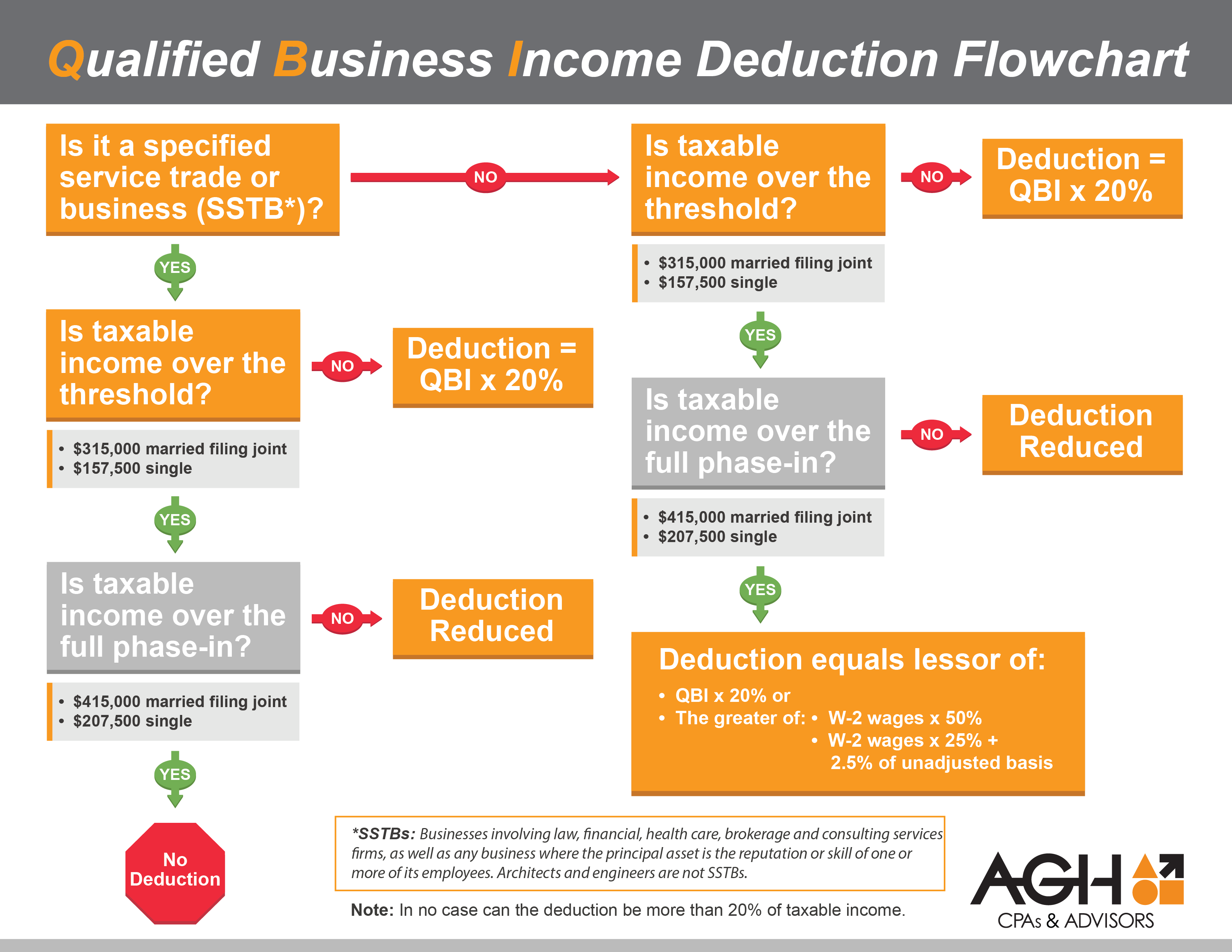

The qualified business income deduction is a valuable opportunity for businesses that operate as pass-through entities. This flowchart is designed to help you to understand if your organization is eligible.

Questions?

For more information, contact Shawn Sullivan using the information below.

Executive Vice President

Tax Services

Shawn leads the firm’s tax group and serves on AGH’s board of directors. In addition to enhancing business performance to minimize tax consequences, he has extensive experience in mergers and acquisitions, international tax and business structuring. Shawn has public and private experience in the fields of tax and accounting and works frequently with clients in the manufacturing, automotive, wholesale distribution, real estate development and construction industries.

A certified public accountant, Shawn is a member of the American Institute of Certified Public Accountants, the Kansas Society of Certified Public Accountants (KSCPA), and the KSCPA Committee on Taxation.